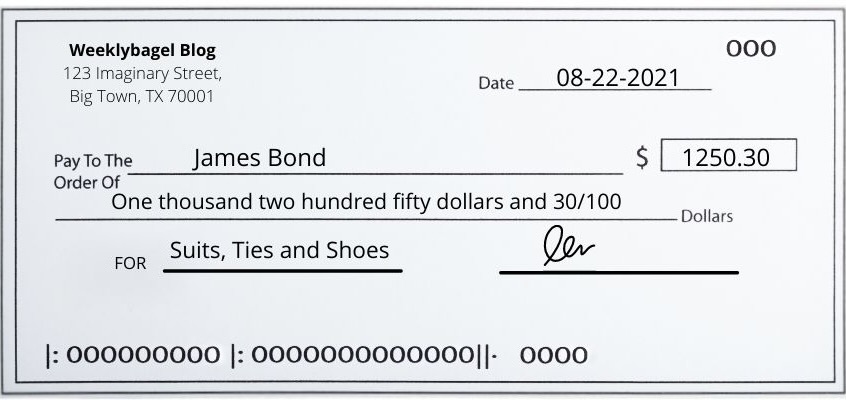

Legal amount: This is a blank line followed by "dollars" and is where you'll write out the check's amount in words.You'll put the check's amount in numerals here. Written amount: This is a blank box on the right side of the check.Payee: This field begins with "Pay to the order of" and is where you'll write the name of the check's recipient.The dateline: This is where you'll write the date on which you're issuing the check.It's important to understand the unique fields a check contains, as well as which ones you'll be responsible for.

For example, if you're sending a birthday check to a loved one unannounced, you might add "21st birthday gift." If you want, you can also fill in the memo line and note what the check was used for (e.g., "lawn services.") This is not required, but you might want to do it to inform the recipient what the money's for - or simply to keep a record for yourself. This shows that you, the account holder, approved the check. Sign the checkįinally, sign the check using the line in the bottom right-hand corner. Make sure these two amounts match, or the recipient won't be able to deposit the check. On the longer line under the payee's name, write the amount in words (i.e., one hundred and fifty dollars and ninety-nine cents OR one hundred and fifty dollars and 15/100 cents). In the blank box on the right side of the check, write the amount in numbers (e.g., $150.99). You can also put a business name on the payee line if you're buying from a company or service provider. Make sure to use their properly spelled legal name (not a nickname), or the recipient may have trouble cashing or depositing the check. On the "For" payee line, write the name of the person you're paying in clear, legible handwriting using black or blue ink. If the recipient were to deposit it earlier, you could risk overdrafting your account. This can be beneficial if you're waiting to have enough funds in your account to cover the payment, but there is also risk: According to the Office of the Comptroller of the Currency, banks aren't required to wait until that date to process the check. This is called "postdating" a check, and it can encourage the recipient to hold off depositing the check until a certain date. Some people may write a future date on their check, though this is generally not recommended. On the top right corner of the check, you'll write the current date, being sure to include a month, day, and year.

Check number writing how to#

Let's start with how to write a check: 1.

0 kommentar(er)

0 kommentar(er)